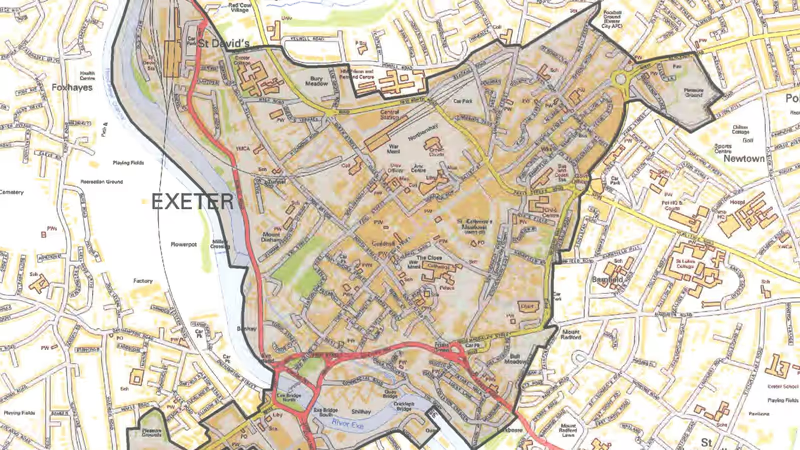

Proposals to increase council tax charges on underused Exeter housing stock have revealed that 433 homes in the city currently stand empty and another 505 are second or holiday homes, together more than the 933 new homes built here in the past two years.

Exeter homes which have been empty for between two and five years, of which there are 50, are currently charged double the normal council tax rate for their band, while those that have been empty for between five and ten years, of which there are twelve, are charged triple.

The three houses in the city that have been empty for ten years or more are charged four times the normal rate.

However no council tax is payable for the first two months for homes that stand empty, and a 50% discount applies for up to twelve months to homes that are empty during structural repairs.

Exeter City Council is proposing to target the 368 empty homes that are currently eligible for these discounts, as well as another 505 second or holiday homes in the city, with new powers being introduced in the government’s Levelling-up and Regeneration Bill.

These will allow councils to begin charging double the normal council tax rate for “unoccupied and substantially unfurnished” empty homes after one year, instead of two, and to introduce the same premium for second or holiday homes which are “substantially furnished” but no-one’s sole or main residence.

The council hopes the new charges will generate up to £1.5 million in additional annual council tax revenue, of which it would keep around £123,000, while encouraging the return of empty homes to use and the use of second homes as main residences.

However implementing the new charges will require additional council resources and their impact on wealthy owners of multiple properties is unclear.

Twenty of the Exeter second homes that are likely to be affected are worth more than £820,000 and one more than £1.6 million, while the council tax charges for most second or holiday homes in the city range between £115 and £153 per month.

Twelve months’ notice of the new charges is required, so if they are adopted by the council this month and the levelling-up bill receives royal assent by the end of March they will come into force in April next year.

Teignbridge District Council passed a similar policy last month from which it hopes to raise around £225,000 and East Devon and Mid Devon district councils are expected to follow suit in three weeks’ time, each hoping to raise around £400,000 additional revenue.

Cornwall Council, a unitary authority which keeps 81% of the council tax it charges, expects to raise an additional £25 million each year from the county’s 13,292 registered second homes.

Pedestrians pass a rough sleeper at Exeter Guildhall

Pedestrians pass a rough sleeper at Exeter Guildhall

The new legislation is partly intended to close a loophole which allowed owners of empty homes to furnish them as if they are second or holiday homes to avoid paying increased council tax charges.

Homes that are used as short-term holiday lets (including Airbnb rentals) are often not liable for council tax as they must instead be registered for business rates if they are available for more than 140 days each year.

However doing so means they are likely to be eligible for small business rates relief and other financial benefits which frequently mean neither council tax nor business rates are paid on properties used this way.

The rapid rise in UK second and holiday home ownership has been accompanied by falling owner-occupancy rates.

British households owned 873,000 second homes in 2018-19 – many owning more than one – of which 495,000 were in the UK, a figure that nearly doubled over the preceding decade.

These assets represent around £1 trillion in property wealth. The number of UK adults in families with wealth from properties in addition to their own home has risen by more than half this century to around one in ten of the population.

However by 2019 64% of the UK’s 23.2 million households were owner-occupiers, a fall from 71% in 2003.

2021 census data shows Exeter owner-occupancy rates of just 58.3% with much higher levels of private rented household tenure than across the rest of the country.