Exeter City Council’s auditor has identified significant weaknesses in Exeter City Living governance arrangements that could lead to “significant loss or exposure to significant financial risk” for the council in relation to loans it approved to the company.

By the end of March last year the council had approved loans to the company totalling £24.6 million despite the company accumulating losses of £2.2 million in its first two years of trading.

The auditor’s report, which concerns the 2020-21 financial year, identifies governance weaknesses including the absence of a 2021-22 business plan for the council-owned and funded company, the council’s failure to require company performance reports, and conflicts of interest created by council directors with statutory legal and financial responsibilities holding company board roles.

The report is also critical of the council’s practice of taking all decisions related to the company in private and withholding company business plans and reports from the public.

Exeter City Council 2020-21 external audit report key recommendation

Exeter City Council 2020-21 external audit report key recommendation

The auditor issued a “key recommendation”, as required by the National Audit Office, setting out actions that the council should take where significant weaknesses in its financial arrangements have been identified, as well as nine related improvement recommendations.

A formal review of the council’s progress on making the required changes will take place next year, following an external review of the company’s governance arrangements that the council has now commissioned.

Two senior council directors have already resigned from the company’s board as well as the board of Exeter City Group, Exeter City Living’s parent company.

At a council meeting last week the auditor said that such recommendations were not issued lightly, adding that there was significant scope for the council to improve transparency in relation to the company, around its financial affairs in particular, so it could be held to account more effectively.

Exeter City Council 2020-21 external audit report key recommendation (continued)

Exeter City Council 2020-21 external audit report key recommendation (continued)

When Exeter City Living was created in July 2018 the late Pete Edwards, then council leader, confirmed that the council would make Exeter City Living business plans and reports publicly available with only limited, legally-compliant exceptions to cover commercially sensitive financial information.

However by the following year the council was routinely excluding the public from meetings which discuss Exeter City Living and withholding related information and documents.

Exeter Observer responded by systematically challenging the council’s Exeter City Living transparency failures using local government transparency and public information access rights.

We sought the release of company business plans and reports via freedom of information legislation, submitted formal objections to the council’s practice of making decisions about the company in private and exercised public accounts inspection rights to scrutinise the company’s financial affairs.

The council has persistently sought to evade scrutiny despite its statutory obligations, routinely taking months to reply to information requests then supplying extensively redacted documents without proper justification for non-disclosure.

It has repeatedly disputed the legislative basis for transparency in relation to private meetings and simply failed to respond to questions about the lawfulness of company operations.

The auditor’s recent report makes clear that its approach needs to change.

Exeter City Living 2020-21 business plan redactions

Exeter City Living 2020-21 business plan redactions

When Exeter Observer examined all the council’s significant decisions regarding Exeter City Living earlier this year we found that most appeared to breach local government regulations intended to protect the public interest in the use of public land and money.

We also found decisions that were made without any scrutiny at all, including the decision not to produce a company 2021-22 business plan that was criticised in the auditor’s report.

This was taken in private by the council’s chief executive, Karime Hassan, in consultation with Dave Hodgson, the council’s financial director and section 151 officer – then also an Exeter City Living (and Exeter City Group) company director – and council leader Phil Bialyk.

It led directly to the situation criticised in the auditor’s report: not only were company financing and delivery assumptions not updated to reflect changing market conditions, including the impact of the pandemic, the council did not receive any progress reports in relation to the outdated business plan so was “not able to hold the company directors formally to account”.

Exeter City Living 2022-23 business plan redactions

Exeter City Living 2022-23 business plan redactions

Karime Hassan also took the decisions that Exeter City Group would not pursue subsidiary consultancy or retrofit companies in private in April last year.

The council said the powers delegated to the company’s Shareholder Representative (a role he held from September 2020) were sufficient to have taken these decisions, but there does not appear to be any reference to such powers in the company management agreement delegation scheme.

When council officers asked us to raise our concerns about the council’s potential exposure to financial risk in writing, in detail, more than twelve months ago, we were told that the council’s monitoring officer, Baan Al-Khafaji, would investigate. We never received a reply.

However earlier this year she attended an executive meeting to advise it on its response to our objections to the council taking decisions about Exeter City Living in private.

She was also then a director of Exeter City Living (and Exeter City Group) and so legally required to act in the interests of the company despite her statutory role at the council, exactly the conflict of interest criticised in the auditor’s report.

Exeter City Living Vaughan Road development site

Exeter City Living Vaughan Road development site

The council has so far allocated nearly £1 million to Exeter City Living for start up and planning costs, approved loans of nearly £25 million for development delivery, gifted it more than £2 million in land purchase discounts and commissioned or purchased just over £20 million of housing.

The company has also been granted more than £7 million of central government financial support, yet it has completed just 22 housing units in the four and a half years since it was created.

It has delivered so little that it is reduced to claiming credit for St. Sidwell’s Point leisure centre on its website alongside the marketing for its Clifton Hill and Vaughan Road developments, both of which have stalled.

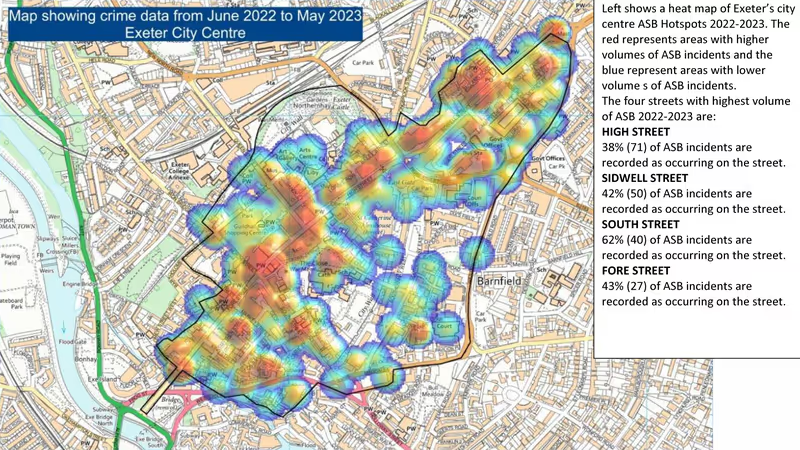

Clifton Hill sports centre closed nearly five years ago but redevelopment hasn’t got past demolition, paid for by the government, with no prospect of further work until 2023-24 or beyond. Vaughan Road is in a similar state, with the site becoming a focus for anti-social behaviour.

The council nevertheless intends to appoint the company to redevelop Mary Arches multi-storey car park, making early use of another government demolition grant despite its delivery record.

Exeter City Council Mary Arches Street multi-storey car park

Exeter City Council Mary Arches Street multi-storey car park

The auditor’s recent report only addresses the company’s activities to the end of March 2021. Important questions remain unanswered about what has happened since.

In June 2021 the council successfully applied for government funding to support development of a total of 461 dwellings on five Exeter City Living sites. Detailed viability assessments were included in its application which specified that three-quarters would be for market rent or sale despite the public procurement rules exemption eligibility requirement that no more than 20% of the company’s activity can be in the private sector.

This exemption is the basis on which the council decided, the following month, to commission the company to relocate its works facility at Belle Isle depot, with a budget of £3.5 million, without competitive tendering.

It is also the basis on which it decided, in September last year, to sell the depot to the company for redevelopment for £2.2 million. The council has also received £675,000 from the government to redevelop this site: its funding bid said 70% of the proposed housing units would be constructed for sale on the open market.

The company’s recent consultation on its plans for the site, which the council did not publicise, said nothing about this use of public land and money to provide so much private housing.

Exeter City Living’s financing and activities are of essential public interest both because residents and businesses are entitled to know what the council is doing with these resources and because the company could expose the council to significant risk, as the auditor has now confirmed.

In a recent review of major financial problems at councils in Croydon, Northampton and Nottingham, Exeter City Council’s auditor highlighted the risk of optimism bias in local authority management of public money and criticised council pursuit of political objectives without effective scrutiny.

It said these can lead to failures to understand the risks of embarking on complex, major projects without appropriate due diligence, and emphasised the value of decision-making scrutiny.

The auditor is due to report on the council’s performance during the 2021-22 financial year in January. Not only does this period cover unanswered questions about Exeter City Living, it brings significant issues around council governance arrangements and decision-making in relation to Exeter City Futures and Exeter Development Fund into focus too.