When the new chancellor launched the government’s growth plan a fortnight ago during his disastrous autumn statement, misnamed a “mini” budget despite its maximal impact, he confirmed that the government was discussing the creation of what it called “investment zones” in 38 local authority areas.

Exeter residents and businesses may have been relieved to read that while Cornwall, Plymouth and Somerset councils were among those that had seized the chance of setting up freeports on steroids on their turf, Devon – and by extension Exeter – had not.

The growth plan didn’t have much to say about the new zones, but it did make clear that they would involve planning deregulation intended to speed up development as well as a range of tax breaks for businesses.

An accompanying factsheet said: “The need for planning applications will be minimised and where planning applications remain necessary, they will be radically streamlined.”

Last week, however, the government invited the remaining local authorities in England to get involved in the scheme, having published more detailed guidance on its plans for the zones.

They include planning “simplifications” that will “cut back unnecessary bureaucratic requirements and processes and red tape that slow down development” with a “faster and more streamlined consent to grant planning permission” intended to “reduce many of the burdensome requirements” of current planning policy.

There is particular emphasis on reducing “lengthy consultation with statutory bodies” and relaxing “key national and local policy requirements” alongside calls to action such as “the planning system will not stand in the way of investment and development”.

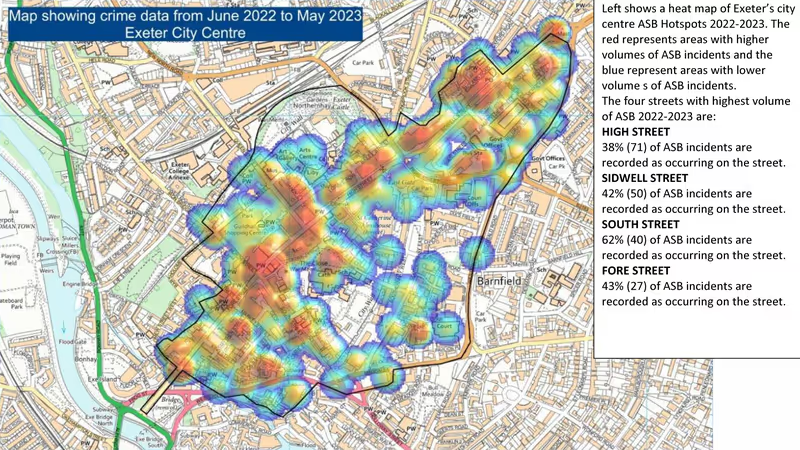

Exeter City Council outline draft local plan site allocations: the Liveable Exeter sites marked in blue could all become deregulated investment zones

Exeter City Council outline draft local plan site allocations: the Liveable Exeter sites marked in blue could all become deregulated investment zones

So Green party councillor Amy Sparling’s question to Labour city council leader Phil Bialyk at a scrutiny meeting last Thursday was pertinent and timely: she wanted to confirm what the council’s response to the government’s invitation would be and, in particular, that it would not lead to planning deregulation in Exeter.

Despite Labour shadow minister Lisa Nandy warning that affordable housing provision and environmental protections would be at risk in new investment zones, and attacking the plans as “reckless”, the council leader said that “officers are exploring how investment zones could support the long-term viability of sites including those identified as Liveable Exeter”.

However much the council, and those promoting Exeter Development Fund, might like the sound of long-term tax waivers covering profits, stamp duty and capital spending on Liveable Exeter development sites, it needs to tread very carefully.

The government’s investment zone application guidance makes clear that eligibility for the scheme is conditional on confirmation that council leaders support the zones in principle, and seeks agreement from councils that they will adopt a “new streamlined overarching planning system” intended to fast-track planning consent in the zones before spelling out what the new system might look like.

As Town and Country Planning Association policy director Hugh Ellis says, investment zones are “designed to be the ideological avant-garde for a concept which the government would like to apply on a much wider basis”. Namely the zonal planning reforms which the government tried to introduce in 2020 but dropped “because it was clearly about stripping out democracy and basic standards from the planning process”.

Even without these considerations, there is little evidence that deregulated, low tax zones deliver the economic benefits that politicians promise. A Centre for Cities study found that the previous generation of such zones mostly displaced jobs, without creating them, and those they did create were “mainly in low-skilled local service activities”. Nor do they boost economic performance, according to the Office of Budget Responsibility.

However many investment zones the government creates, and it does look like being many, they will confer next to no competitive advantage as each will have to go head to head with all the others for the same, limited investment sources. At the same time affordable housing provision and environmental protections will be at risk wherever they are introduced.